Introduction

As Vietnam’s rapid development and economic growth continue to fuel M&A activity, domestic and foreign companies increasingly find their deals subject to Vietnam’s merger control regime. The Vietnam Competition Commission (VCC)’s recently published report for 2024 shows increases of 8.7% and 29.2% on 2023 and 2022 respectively in the number of transactions notified to the VCC.

Fully operational since 2023, the VCC is the State body responsible for overseeing and applying the 2018 Competition Law and two implementing legislations: Decree 35/2020/ND-CP (setting out filing thresholds and substantive assessment criteria) and Decree 75/2019/ND-CP (setting out administrative sanctions) (the Competition Regulations).

Dealmakers are increasingly needing to factor in merger control clearance in Vietnam as investment into the country grows. The VCC is also reportedly considering refining the rules to reflect the increasing deal activity. In this blog, we discuss Vietnam’s evolving merger control regime and recent filing trends.

Jurisdictional reach of the regime and enforcement

A transaction must be notified if any of the following thresholds are met:

Total revenue / assets on a group-wide basis exceeds VND 3 trillion (c. USD 114 million) in Vietnam in the previous financial year.

Transaction value exceeds VND 1 trillion (c. USD 38 million) in the case of onshore transactions.

Combined market share on the relevant market exceeds 20%.

In line with many merger control regimes elsewhere, separate, higher thresholds apply to transactions involving financial institutions. In 2024, the VCC received 197 notifications, 79% of which met the revenue or asset thresholds, while the remaining 21% triggered the transaction value or market share thresholds.

Deals with a foreign element accounted for nearly half of notified transactions in 2024. Of the 197 filings in 2024, 40% of them were foreign-to-foreign transactions, and 8% involved foreign enterprises acquiring Vietnamese companies. For the first time in 2024, the total number of foreign companies involved in reviewed merger filings outnumbered domestic ones, accounting for 52%.

The significant increase in the number of filings reflects, in part, the relatively low jurisdictional thresholds and the number of onshore intra-group reorganisations notified to the VCC. There is currently no formal exemption for intra-group re-organisations, even if there is no change of control at the ultimate shareholder level.

Enforcement of the Competition Regulations has thus far been limited. However, in 2024, the VCC imposed a c. USD 50,000 fine on a domestic chemicals company for failure to notify an acquisition to the VCC. In addition, the Ministry of Industry and Trade has recently released a draft decision recognising the Competition Regulations as a central focus of the political system and setting out targets of “improving the efficiency of competition law implementation [and meeting] the requirements of wide … international economic integration”. It is safe to say that competition law is now firmly on the government’s radar.

Review process and timing

The merger control process in Vietnam involves two phases and can be long ranging, from 2-3 months for Preliminary Appraisal (or Phase I) reviews to upwards of 6 months in the case of Official Appraisals (or Phase II) reviews:

- Phase I: The VCC must assess the completeness / validity of a notification within 7 working days of receiving it. If clarification is needed, merging parties have 30 calendar days to respond to a request for information. Once the filing is deemed complete, the VCC has 30 calendar days to either clear the transaction or proceed to a Phase II review. It is not uncommon for the VCC to reject and return filings as invalid or incomplete. In 2024, the VCC rejected around 18% of filings. In such a case, the merging parties need to collect the submitted filing from the VCC, work on the filing to address the deficiencies and resubmit it to the VCC.

- Phase II: The VCC has 90 calendar days for transactions requiring in-depth review, which can be extended to 150 calendar days. The VCC may “stop the clock” by issuing requests for information which pauses the timeline until the merging parties provide responses. It is not uncommon for transactions resulting in market shares exceeding 20% in an overlapping, vertically-related and/or conglomerate market(s) in Vietnam to progress to Phase II review (although this represented less than 2% of cases in 2024).

Between 2023 and 2024, the VCC initiated seven Phase II reviews. The VCC can impose structural or behavioural remedies, although no transactions to date have reportedly been cleared subject to structural remedies. For those transactions that reach Phase II, the likelihood of remedies is high. Examples of such remedies include reporting obligations that require parties to provide detailed information on business activity in Vietnam.

Recent filings trends

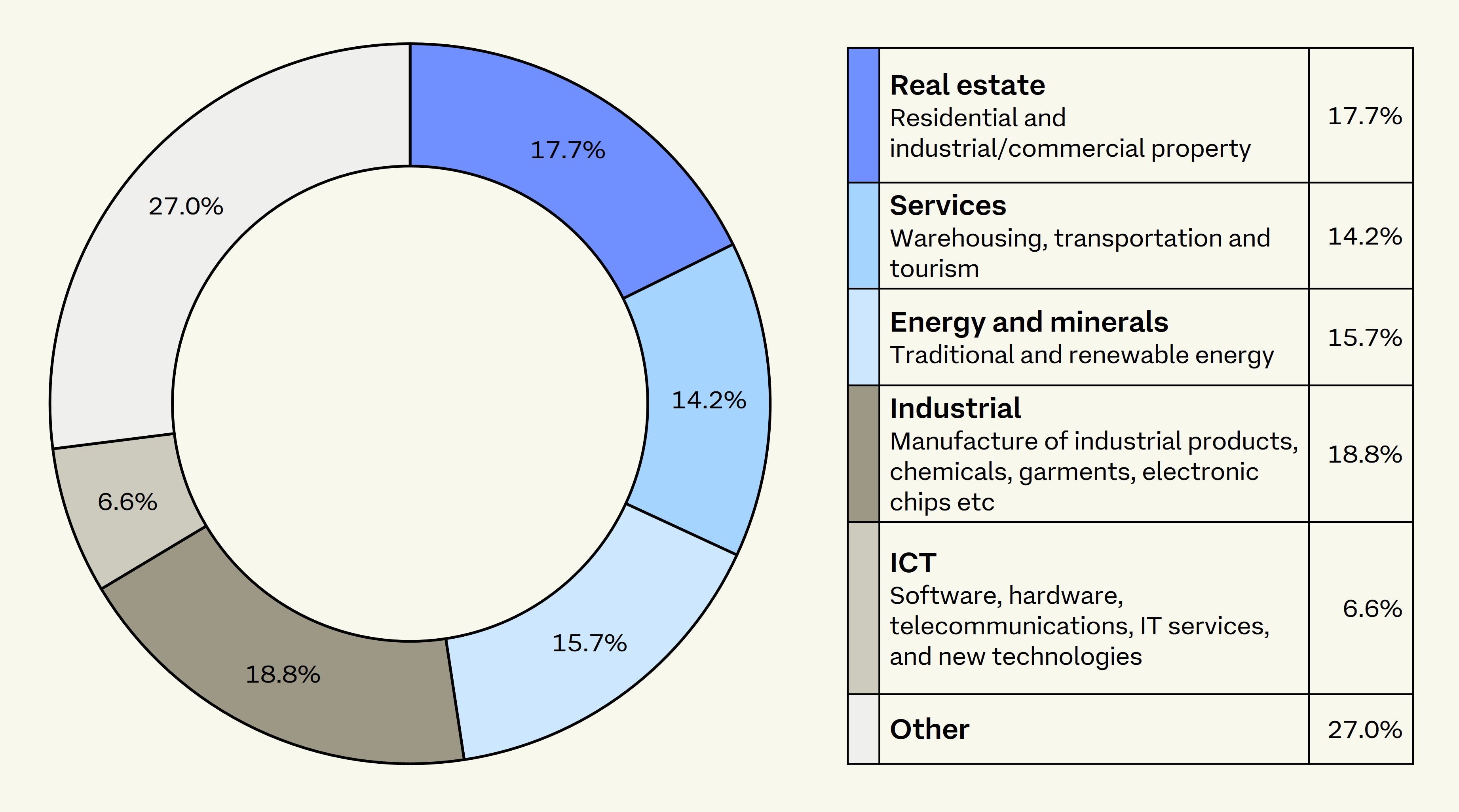

The majority of notified transactions in 2024 (c. 73%) concerned five sectors:

VCC filings by sector - 2024

Source: VCC Report on Economic Concentration Control in 2024

In line with global trends, the VCC highlights technology as a key sector (with a total transaction value in 2024 of VND 31.65 trillion (c. USD 1.2 billion). This has led to an increase in technology-related filings (e.g., transactions involving healthcare- and education-related software). The government is separately passing a range of tech-related legislation, including a recent public consultation on the draft Digital Transformation Law. We expect to see this trend continue as the global uptake of AI and related technologies continues to grow.

Other sectors attracting significant M&A activity in Vietnam include real estate, which continues to perform strongly by total transaction value (VND 27.5 trillion (c. USD 1 billion) in 2024). Other key sectors to watch in 2026 include education, healthcare and consumer/retail.

Looking ahead

The VCC is making positive steps towards keeping pace with Vietnam’s economic growth, acknowledging the role that an effective competition law regime can play in its developing economy. For example, the VCC is streamlining its processes with the introduction of an e-filing system for mergers. The VCC is also reportedly considering increasing the jurisdictional thresholds to account for growing GDP and transaction values, as well as streamlining its approach to internal reorganisations.

Additional opportunities to calibrate the rules would be to introduce an express exception for intra-group reorganisations and shifting focus away from the 20% market share threshold that routinely triggers Phase II reviews (including in some cases where there are no overlapping activities). These steps would reduce the number of reviews by the VCC, freeing up its capacity to focus on the most impactful deals in Vietnam.

For now, drafting a notification and collecting information and documents for it, including for no issues transactions, can be time- and resource-intensive. Merging parties can expect some formalism when engaging with the regime. Merging parties should also plan for potentially long reviews if market shares exceed 20% and the transaction slips into Phase II review. Early planning and constructive engagement with the VCC remain critical for timely review of transactions.

/Passle/5b6181bd2a1ea20b0498072f/SearchServiceImages/2026-02-17-16-13-40-963-699493b4051add23620885dc.jpg)