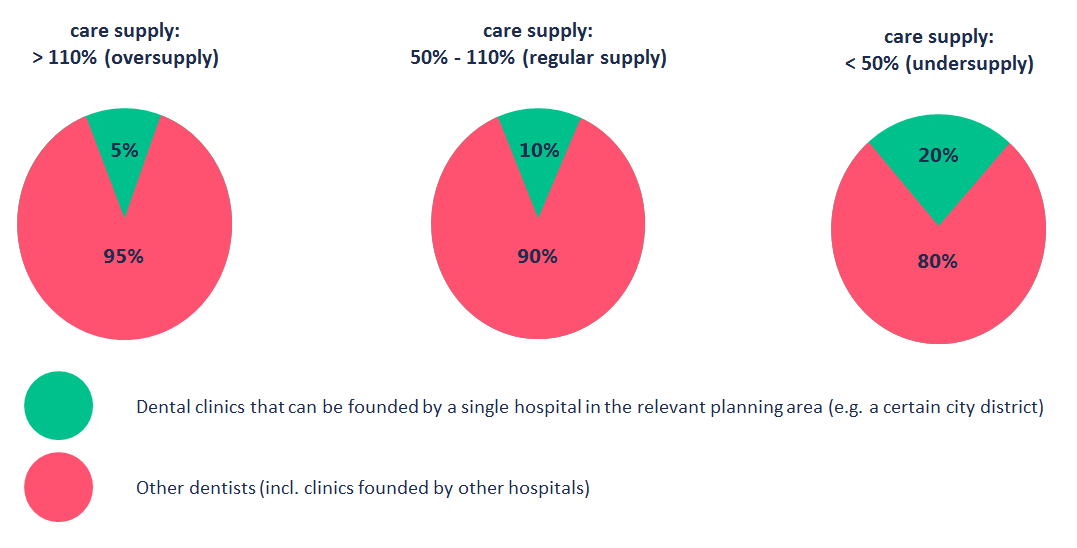

New legislation aims to restrict private investments into dental clinics by placing quotas on hospitals (the investment vehicle currently preferred by investors) as to how many dental clinics they may establish. These quotas depend on the supply in a given area as follows:

Care supply: adequate general care supply (allgemeiner bedarfsgerechter Versorgungsgrad) in planning area (Planungsbereich) of the regional dental authorities (Kassenzahnärztliche Vereinigung).

Share of care supply: share of panel dentist care in planning area (Vertragszahnärzte and angestellte Zahnärzte).

The relevant Appointment-Service-and-Care-Act (Terminservice- und Versorgungsgesetz, TSVG) was adopted by the German Federal Parliament (Bundestag) on 14 March 2019 and is expected to become effective on the 1st of May 2019.

Background

The German market for outpatient care has been a popular target for private equity investors with the deal volume since 2013 exceeding EUR 4 billion of revenues and affecting more than 80,000 employees. An area of particular interest for investors with a buy-and-build strategy have been dental clinics organised as Medical Care Centers (Medizinisches Versorgungszentrum, MVZ).

Originally introduced by the legislator to enable flexible treatment practices for physicians and to make health care services (especially in rural areas) financially more attractive, MVZs enabled investments in outpatient medical care in Germany as MVZ could be set up as a limited liability company corporate structure. Pursuant to a further reform in 2013, only doctors, charitable institutions providing statutory health care, municipalities, hospitals, and providers of non-medical dialysis services were permitted to own such MVZ. Thus, investors in dental clinics sought to acquire hospitals or dialysis centres.

Regulatory changes

The most significant changes concern the permission to establish or enhance existing dental-MVZs.

For hospitals, this will be limited depending on the number of already existing dental-MVZs by that hospital in the respective planning area of the regional dental authorities. A dental-MVZ may only be established by a hospital if all of its dental facilities combined generally do not exceed 10% of the care supply in the respective planning area. In oversupplied planning areas (more than 10% over the general level of care appropriate to needs) this threshold is reduced to 5% of the care supply. In undersupplied areas (under 50% of the general level of care appropriate to needs) a hospital is allowed to cover up to 20% of the care supply.

Dialysis-centres may only establish MVZs in related disciplines (thus not in dental care anymore).

This regulation does not apply to dental-MVZs that have already been established (Bestandsschutz).

Consequences for the market

Investors will have to assess the supply situation in the planning area of interest carefully. Particularly in some urban areas investors will be bound by the tight 5% threshold or might have to consider acquiring additional hospitals. Yet, according to statistics given by regional dental authorities (which will be statutorily required to provide updated care supply numbers as of 31 December of a calendar year by 30 June of the following calendar year), even if there are almost no areas subject to undersupply, there are still quite a few urban areas not subject to oversupply. Even in metropolitan cities such as Hamburg and Berlin there are areas which care supply is 10 % lower than it would be appropriate to needs. Thus there is still a lot of opportunity for the establishment of dental-MVZs by German hospitals. Yet, investors should note that the German health ministry explicitly stated in various instances that this reform is specifically aimed at curbing private equity investments into certain medical practices such that further restrictions in the interpretation of this act by the authorities or legislative actions could ensue in the future.

We have advised on numerous transactions in the healthcare space, including acquisitions of individual MVZs as well as relevant chains and are currently advising relevant investors on navigating these regulatory changes in Germany.

/Passle/5b6181bd2a1ea20b0498072f/MediaLibrary/Images/2024-12-04-16-24-21-724-67508235376ff9ba249f2b08.jpg)