Over the past few weeks we have been speaking to clients on some of the key trends and developments for UK listed companies in the 2023 AGM season. In this blog we summarise some of the key areas of focus for boards.

A key topic of interest this year is the extent to which companies are following the new PEG guidelines on share capital resolutions. In November 2022, the UK Pre-Emption Group (PEG) issued an updated statement of principles and template resolutions to implement recommendations made by the UK Secondary Capital Raising Review, chaired by Freshfields’ partner, Mark Austin. So far this year, approximately half (47%) of the FTSE 350 companies that have published AGM notices have requested an enhanced authority. However many of these notices were published before ISS, Glass Lewis and the IA announced their support for the updated PEG guidance, so we expect a growing proportion of companies to seek the additional flexibility this year.

Early compliance with the Listing Rule on Diversity reporting is also a hot topic amongst listed companies. The Listing Rule significantly expands the scope of reporting on diversity targets beyond voluntary initiatives. We see a trend towards early compliance, with many listed companies going as far as they can to disclose in line with the Listing Rule in advance of the legal requirement to do so. We’ve also seen more focus on ethnic diversity, with campaigns led by ShareAction focusing on ethnicity pay gap reporting and requesting boards to commit to report on this and to commit to the Race at Work Charter.

As in previous years, shareholder expectations on remuneration remains an area of particular focus. Two key reasons for this are: (i) at the start of the pandemic, investors put companies on notice that they didn’t expect executives to benefit from suppressed share prices as and when those share prices recovered (so called “windfall gains”); and (ii) wider economic factors, including a cost of living crisis, which suggest that executives are earning more than they should do. As a result, we are seeing an additional layer of reporting in this area. The 2022 AGM resolutions that received the most votes against were those to approve directors’ re-elections (38%), the annual remuneration report (28%) and the remuneration policy (10%) and so far in 2023 that trend looks set to continue. ESG-based performance metrics are also expected to continue to be an area of focus.

2022 saw a return to in-person AGMs, with the majority of meetings (55%) held as purely physical meetings (a further 17% held physical meetings with a live webcast, Q&A sessions, or other digital way to increase shareholder engagement (so called “physical plus” meetings”)). Hybrid meetings – where shareholders have the option of attending in person or virtually – remain ISS’s preferred general meeting model but only around a quarter of companies elected to hold meetings in this way last year. So far this year, purely physical meetings are still the most popular option, however we are seeing a slight increase in companies offering the “physical plus” format. We expect that this trend will become more prevalent as the season progresses.

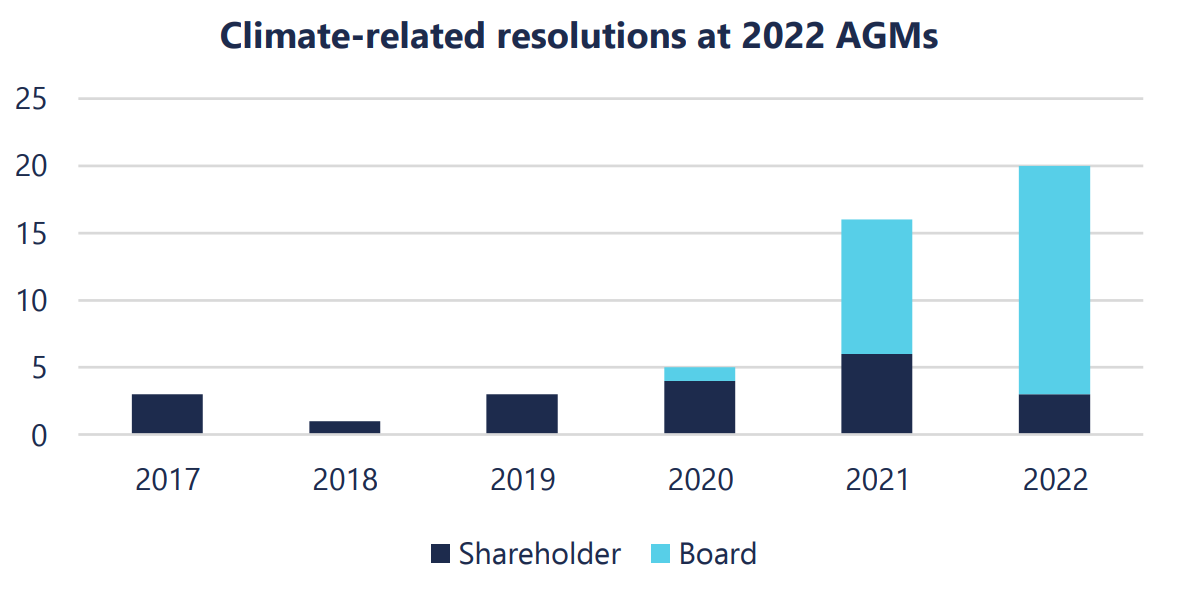

The growing number of climate-related resolutions being put to shareholders of listed companies has been a key trend over the last few years. In the early days of this ‘say on climate’ movement, the majority of resolutions were requisitioned by shareholder action groups. However, more recently there has been a shift to companies putting themselves on the front foot with board-proposed advisory resolutions – principally in respect of the climate-related disclosures. Last year, 17 FTSE 350 companies tabled 20 climate-related resolutions at their AGMs – of which only three were requisitioned by shareholders. In 2022, all board-proposed climate resolutions were passed. In contrast, each of the shareholder-requisitioned climate resolutions failed (and in each of these cases, the board had proposed an alternative climate-related resolution which was successfully passed). As a result of regulatory developments in this area, our expectation is that there will be fewer climate-related resolutions this year and less obvious shareholder pressure in this area.

Listed companies also continue to develop their approaches to sanctions screening, particularly in light of the new strict liability sanctions regime in the UK. This is a complex and dynamic area of law so it is advisable for companies to seek specific advice if they are unsure about the scope of their due diligence or if they discover any sanctioned shareholders, whether direct or indirect, on their registers.

/Passle/5b6181bd2a1ea20b0498072f/MediaLibrary/Images/2026-02-25-14-08-22-737-699f0256b208a223bd0886c1.png)